Boom company update - Recap: 2022 Q4

New product interfaces, Q4 subscriber growth reaching ATHs, hiring for consumer growth/GTM, setting up for a big 2023. Happy hour on March 28 in Austin, TX.

Hi!

Before jumping into it, a quick mention that we will be having our quarterly open bar happy hour in Austin, TX on March 28. If you’re around, pls join! Details: https://www.mixily.com/event/2221319666157448860

Reminder about who Boom is and what this newsletter is at the bottom.

Progress in 2022 Q4

TL;DR: we wrapped up Q4 in an effort to put finishing touches on our 2022 theme of ‘foundation’: foundation of people, product, processes. We saw revenue and subscribers hit record highs, implemented numerous consumer product improvements, launched our Partner Portal (for b2b customers), started a major uplift on our external presence (e.g. app reviews, website), hired for growth, and won new clients/partnerships. Great quarter. More detail below:

Grew paying subscribers → paying subscribers grew 44% from end of 2022 Q3 to end of Q4 on the back of our homegrown affiliate network and strong word of mouth. December was our highest revenue month of all time.

Went live with our Partner Portal with early partners → completed product work on our v1 portal, signed early landlords and financial services partners. More to come here.

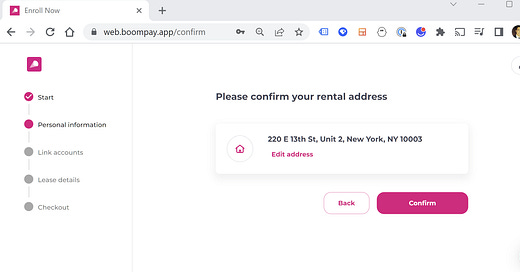

Launched our v1 web enrollment → gives us the flexibility for embedded experiences with fintech/proptech partners, and lowers enrollment friction for consumers in specific deployment scenarios.

Launched our new website → our last website was awful. New site better represents our brand and drives meaningfully better conversion (and lower customer confusion due to clearer product marketing).

Dramatically improved our app reviews → we never requested reviews from users, leading to mainly negative reviews when users had a bad experience or didn’t see a credit score improvement. With the product in a better place, we focused on reviews in Q4. Took us to 4.5+ star avg rating across iOS and Android.

Hired for growth → brought on Dan Sinner as a fractional CMO. Dan spent 10+ years at Happy Money, leading growth, brand and all things customer-related from the time the business was a napkin idea to unicorn status.

Industry news

Our competitor Till was acquired by a consumer lending company, helping to take out one competitor from the picture. Bilt raised a large round to accelerate rewards, an adjacent space to us. Rhino acquired Deposify. Space is heating up.

Asks

Know any candidates for Sr. Product Manager (first product hire) (https://angel.co/l/2y7fj5)? 5+ years of experience, consumer mobile, highly organized, ideally some technical background. Austin, TX-based (or can relo). Flexible on title. Check this list: 1st/2nd-DEGREE CONNECTIONS ENG-FOCUSED PRODUCT MANAGER (TX-BASED)

Please reshare / comment / like this recent post (for PM hire): https://www.linkedin.com/posts/robwhiting_fintech-hiring-product-activity-7041138649589047296-V_OK

If you see someone who looks good: pls share link or screenshot, thank you! 🙏

What could be better

Missed on Head of Ops hire: We brought a Head of Operations hire to Austin for 4 weeks on a fully paid trial.-It didn’t work out. We should have trusted our gut in the interview process.

B2B bus dev slowed down in Q4: holidays slowed things, a couple leads had massive layoffs, and we were overall fixated on improving the core consumer experience. Seeing things ramp up again in Q1.

What’s next

Focus areas for the next quarter (2023 Q1) include:

Improve the core consumer experience (rent reporting) → leaps and bounds improvements in Q4, but many kinks remain in the UX: bank linking has issues, fraud prevention needs improvement, plan to swap identity verification provider (to Plaid IDV), etc.

Dramatically improve rent reporting verification and furnishment → payment/landlord verification need to improve (will implement v3 version) to get users enrolled faster and manage volume. We’ll also improve speed and accuracy of Metro 2 furnishment.

Start consumer growth efforts → this was a miss in Q4, but now that we have Dan on board to lead this, we’ll start this in earnest in 2023, with initial focus on KPIs/metrics baseline and integrations.

Go more public with Boom → continuing on this external-oriented theme of consumer growth, we’re going to start sharing more about Boom. As of writing, you can see one small example of this here: Announcing Boom (Feb 2023)

Launch new B2B partners → in Q4 we established new interfaces (e.g. Partner Portal, web enrollment) and cleaned up our brand, now enabling us to make more inroads here.

Thanks!

Rob and Kirill

P.S. You’re receiving this email because you’re either a current Boom investor, investor we’ve interacted with in the past, or another friend of Boom. ~4 emails per year, unsubscribe at any time, no hard feelings.

Quick reminder about who we are:

Boom is on a mission to level the playing field for the 110+ million renters in the US by making housing more flexible, affordable, and rewarding. We’ve started by building an app to help renters build credit with their largest monthly expense: the rent payment. Now serving thousands of renters, Boom is led by second-time founders Rob Whiting (ex-BCG, Rubicon) and Kirill Moizik (Eco, Technion, Grubhub). It's backed by investors such as Starting Line, Clocktower Ventures, Gilgamesh Ventures (Petal co-founders), and angels such as William Hockey and Zach Perret (Co-founders of Plaid) who anchored Boom's pre-seed round (joined by Harry Stebbings and others from places like Cash App, Mint House, Landis, Party Round, and Redfin).