Boom company update - Recap: 2023 Q2-Q3

New product releases, several new hires, all-time high users, upcoming product announcements, company offsite, and more. Happy hour on November 29 in Austin, TX.

Hi everyone!

Quick heads up that we’ll be having our quarterly open bar happy hour in Austin, TX on Wednesday, November 29. If you’re around, pls join (thanks to everyone who joined for the last one)! RSVP here: Boom’s Q4 Happy Hour @ Upstairs at Caroline

Reminder about who Boom is and what this newsletter is at the bottom.

Progress in 2023 Q2-Q3

TL;DR: in Q2-Q3 things only moved faster. With a lot of our foundational technical and data work complete (e.g. releasing our furnishment ‘tradelines’ functionality), Q2 and Q3 were more about offense and net new initiatives.

We primarily did two big things:

First, we released Boom for Property Managers. This is our platform for PMs and landlords to interface with the Boom suite of solutions, starting with rent reporting.

Notably, Boom for Property Managers is the first SaaS solution for rent reporting in the industry.

After receiving increasing interest from property managers and owners, we were surprised to learn that existing B2B players were primarily spreadsheet-driven, utilitized 3rd party data processors, and were highly error prone, all leading to headaches for property managers and renters.

"Boom's rent reporting platform has helped me upgrade my resident offering," said property owner and operator Johnathan V. of DBI Management. "I looked at other products for reporting rent, but Boom was the only one that provided real transparency of what data was being reported and when, and it eliminated the need for spreadsheets."

As we've transitioned property managers off their current provider to Boom, we found that on average only 70-80% of intended renters are actually being reported at all. In many cases the other rent reporting companies marketed that they reported to all 3 bureaus, while this turned out to not be the case. We’ve also rectified data issues created by prior rent reporting companies.

Boom for Property Managers is our offering to level up the industry and give property managers back their time and renters the credit they deserve.

I talk more about it on LinkedIn, and press release is here.

Second, we defined our 2023 H2 strategy, product roadmap, and next product. This was through a combination of a 2-month customer discovery and market-mapping exercise followed by a 2-day full leadership session. We’ll be sharing more on this soon.

There were several other accomplishments from Q2-Q3:

Continued subscriber growth → subscribers continued to grow to all time highs and Q2 and Q3 were two of our top three grossing months ever. We had a number of learnings on growth experiments.

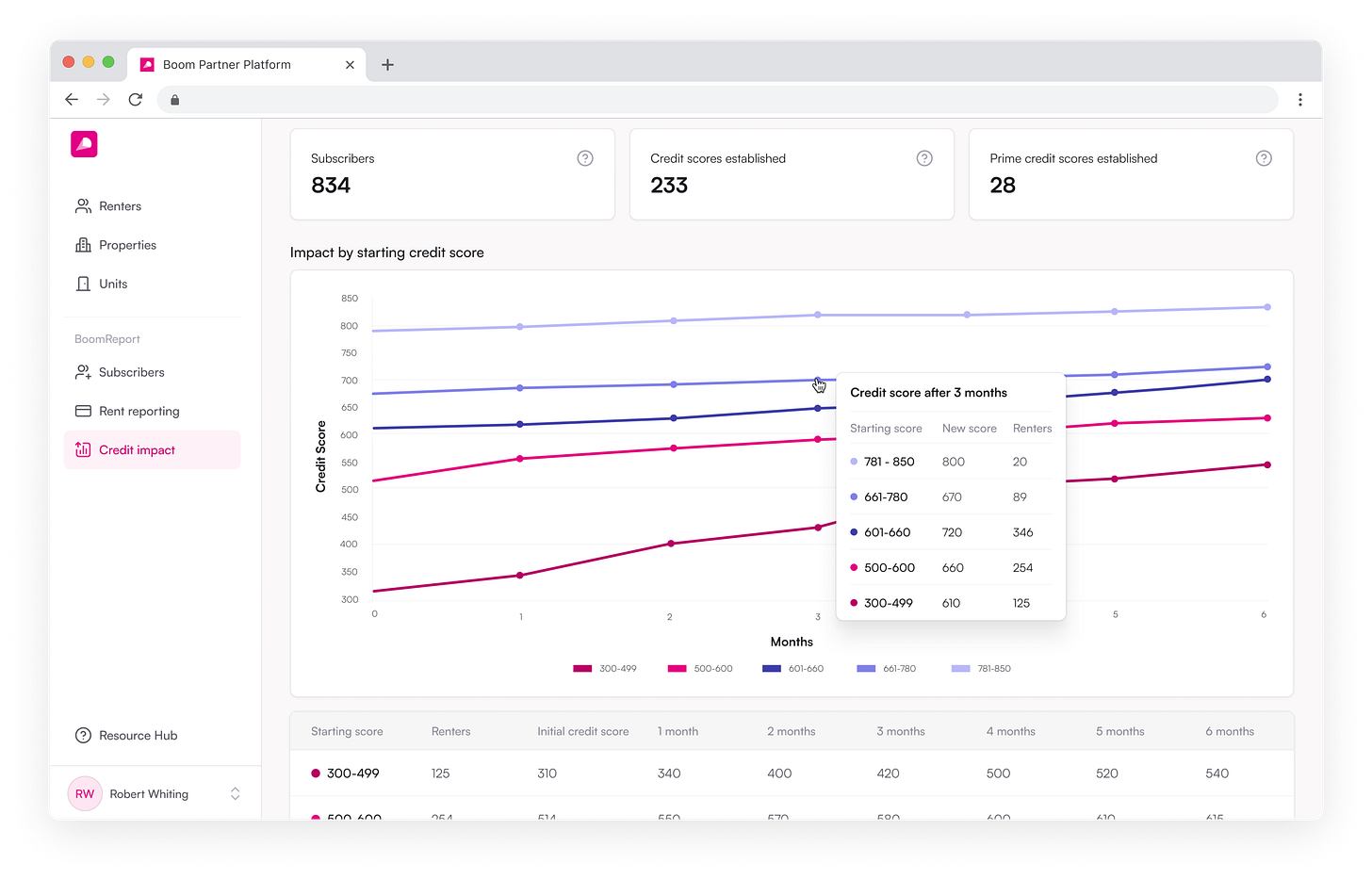

Went live with our real-time credit impact dashboard → shortly after going live with Boom for Property Managers, we released our credit impact dashboard feature. This is not a monthly static report, but rather a real-time, filterable dashboard for our property managers to see the impact of Boom on their portfolios.

Launched new PM software integrations → we released integrations with Rent Manager, ResMan, and Buildium. More to come here.

Released new data verification and furnishment updates → compounding the gains we talked about in the last update, in Q2-Q3 we further built out our data furnishment capability, including closed-loop confirmation of tradeline accuracy and new data verification and fraud detection parameters.

Accelerated hiring: we were slower to hire when things were a bit crazier in 2021-2022, but now we’ve started to fill key positions, including Kurtis Rhee as our Head of Operations and Eric Schumacker as our Lead Product Manager, as well as several fantastic engineering hires. Next up: sales and growth.

Industry news

A couple of the highlights…

Rent Dynamics acquired by Entrata: Entrata acquired Rent Dynamics for what was reportedly >$100m (I’ve heard meaningfully higher, if you know the figure lmk), and it was largely due to the rent reporting functionality. Great win for the industry. And, we’ve secret shopped Rent Dynamics and were not blown away by the platform that the 10-year old company developed. Rent Dynamics only reports to Equifax and TransUnion, not Experian (Boom reports to all 3 🙂).

Open banking and alternative data gaining prominence: the CFPB issued the long-awaited open banking regulation (read more about implications here). Our friends at Plaid launched a credit bureau, while Petal-spinoff Prism raised funding, and our friends at Nova Credit (who’ve had a credit bureau for a while now) continue to scale.

Asks

Connections to landlords/PMs: do you know any apartment operators, especially those in small-medium multifamily Class B, and single-family rentals? This won’t be a sales call, but rather a compensated ‘discovery’ interview. Here’s a simple pre-filtered LinkedIn list to jog your thoughts.

Sales candidates: we’re hiring a Commercial Lead, our first sales hire, in order to move faster (and help me get some sleep). Ideally based in Austin. JD here: https://wellfound.com/l/2ziXKo. Check this pre-filtered LinkedIn list.

Introductions to HUD: we have a few things in mind based on current and upcoming products on how we might be able to support them. Know anyone there? Check this pre-filtered LinkedIn list.

What could be better

Didn’t hire sales teammates: my (Rob) capacity has become a limiting factor as I’m the only revenue generator in the business. See the ‘ask’ above. We’ll rectify this in Q4.

Conference preparation: had a couple great conferences, and a couple that were mediocre. Mostly this was due to limited prior preparation (my fault), and this is our first year doing conferences, so we’re still determining which ones are hits.

What’s next

Focus areas for the next quarter (2023 Q4) include:

Launch our next B2B-facing product → as we completed a customer discovery process in June to identify the next extension of our Boom for Property Managers platform, the team has been hard at work on the product buildout. We plan to have this product live in production with design partners this quarter.

Implement a repeatable B2B sales motion → we currently have minimal process and structure, and have been largely been responding to inbounds with founder-led sales. We’ll start to systematize things in Q4.

Hire sales and growth teammates → aligned with the point above, we’ll more deeply invest on hiring here this quarter.

Launch new property management software integrations → on the tail of launching integrations with Rent Manager, etc., we have at least 2 new integrations we’ll go live with.

Define our next (likely consumer) product → as we continue on our strategy of building on both sides of the marketplace (renter x B2B - i.e. landlord/PM/fintech), now that we have our next B2B product in build, we’ll be designing our next product, likely to be a DTC-applicable product.

Thanks!

Rob and Kirill

P.S. You’re receiving this email because you’re either a Boom investor, investor we’ve interacted with in the past, (potential) customer, (potential) partner, or another friend of Boom. ~4 emails per year, unsubscribe at any time, no hard feelings!

P.S.S. A few photos from our recent working offsite in San Antonio, including tubing, a murder mystery, karaoke, and overly competitive pickleball.

Quick reminder about who we are:

Boom is on a mission to level the playing field for the 110+ million renters in the US by making housing more flexible, affordable, and rewarding. Boom is building a suite of rental financial services, starting with rent payment reporting to help renters build credit with their largest monthly expense, and expanding to tools across the renter journey. Now serving thousands of renters, Boom is led by second-time founders Rob Whiting (ex-BCG, Rubicon) and Kirill Moizik (Eco, Technion, Grubhub). It's backed by investors such as Starting Line, Clocktower Ventures, Gilgamesh Ventures (Petal co-founders), and angels such as William Hockey and Zach Perret (Co-founders of Plaid) who anchored Boom's pre-seed round (joined by Harry Stebbings and others from places like Cash App, Landis, Affirm and Redfin). Boom has been profiled by Inman, Business Insider, HousingWire, NerdWallet, and more.